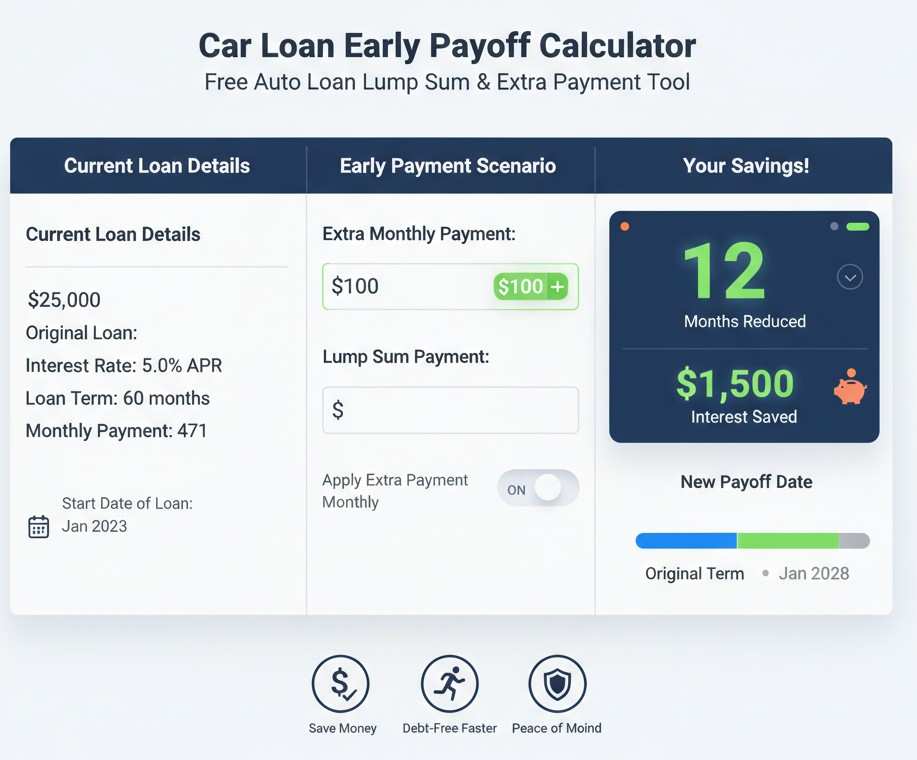

Auto Loan Early Payoff Calculator

Results

Total savings: $0.00

Monthly prepayment amount: $0.00

Car Loan Early Payoff Calculator – Save Interest & Pay Off Faster

Are you thinking about paying off your car loan early? Our Car Loan Early Payoff Calculator helps U.S. drivers see exactly how extra payments or a one-time lump sum can shorten loan terms and save thousands in interest.

Whether you’re planning to pay off your auto loan early with extra monthly payments or make a single large payment, this free tool shows your new payoff date and total savings instantly.

How the Auto Loan Early Payoff Calculator Works

📘 Loan Amortization in Simple Terms

Car loans are amortized, meaning each monthly payment goes partly to interest and partly to principal. In the beginning, most of your payment covers interest.

➡️ By making extra payments, you reduce the principal balance faster, which lowers future interest charges.

💰 Calculate Interest Savings

See exactly how much interest you’ll save by paying extra. Even an additional $50–$100 per month can save you hundreds or even thousands of dollars.

📅 Shorten Your Loan Term

Enter your loan balance, rate, and term. Add an extra monthly payment or lump sum. The calculator instantly updates your payoff date.

Why Pay Off Your Car Loan Early?

✅ 1. Save on Interest

Making extra payments reduces your total loan cost.

Example: A $20,000 loan at 6% interest for 60 months — paying $100 extra monthly could save $900+ in interest and shorten your term by almost 1 year.

✅ 2. Improve Credit Health

A lower debt load improves your credit utilization. Fully paying off an installment loan also strengthens your long-term credit profile.

✅ 3. Gain Financial Freedom

No more car payments = more room in your budget for savings, investments, or lifestyle choices.

When Should You Consider Early Payoff?

🧾 Check for Prepayment Penalties

Some lenders charge fees for paying early. Always check your loan agreement or contact your bank before making extra payments.

💸 Assess Your Finances

Make sure you have an emergency fund in place. Paying off a loan is smart, but don’t sacrifice savings or financial security.

🎯 Align with Your Goals

Use the calculator to test scenarios — extra $100 monthly vs. $1,000 lump sum — and see which fits your budget best.

Types of Car Loan Payoff Calculations

🚗 Extra Monthly Payments

See how paying a little extra each month shortens your loan.

💵 Lump Sum Payments

Check the effect of making a one-time payment toward your principal.

🔄 Combination Strategy

Combine lump sum + extra monthly payments for maximum savings.

How to Use the Calculator

1. Enter Loan Details

- Current loan balance

- Monthly payment amount

- Interest rate

- Remaining months

2. Add Extra Payment

Choose monthly extra or a lump sum.

3. Review Results

Get your new payoff date, reduced interest, and savings.

FAQs: Paying Off a Car Loan Early

Q: Is it smart to pay off a car loan early?

A: Yes, especially if your loan rate is high. and You will save on interest and reduce debt faster.

Q: What’s better — extra payments or lump sum?

A: Both help. Extra payments give steady progress, while a lump sum creates a big immediate impact.

Q: Does paying off early hurt my credit score?

A: Sometimes there’s a small dip short-term, but overall, reducing debt improves your credit.

Q: Can I use this calculator for any auto loan?

A: Yes, it works for all U.S. fixed-rate auto loans.

Q: How do I pay off a car loan faster without penalties?

A: Check your lender’s prepayment policy, then use this calculator to plan safe, penalty-free early payoff.

🚀 Ready to Pay Off Your Auto Loan Faster?

Try our free Car Loan Early Payoff Calculator today and

See how extra payments or a lump sum can save you money, shorten your loan, and put you on the fast track to financial freedom.