🪙 Introduction – Why a Gold Investment Calculator Matters

Gold is one of the most trusted investment options in India and worldwide and it is not only a safe asset but also a part of tradition, culture, and financial planning.

But gold prices change daily. Whether you’re buying jewellery, coins, bars, or digital gold, you need to estimate future returns before investing.

That’s where a Gold Investment Calculator helps – giving you instant ROI, profit, and future value estimates.

Gold Investment Calculator

📱 Android App

Our Gold Investment Calculator app is currently under testing and will be available soon on the Google Play Store. Get ready to calculate your gold returns anytime, anywhere — even offline.

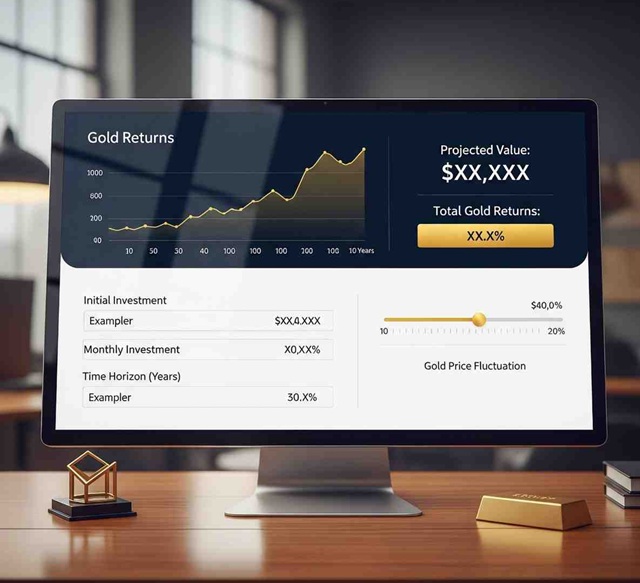

Coming Soon⚙️ How Our Gold Investment Calculator Works

Our calculator uses a simple compound growth formula to project your returns:

Future Value = Initial Investment × (1 + Growth Rate) ^ Years

It allows you to:

✅ Enter the current gold price per gram

✅ Input the quantity you plan to buy

✅ Choose investment duration (years)

✅ Set expected price growth %

✅ Get future value, ROI, and profit instantly

🎯 Benefits of Using a Gold Investment Calculator

- Instant results – no manual math

- Custom predictions – adjust anytime

- Better decisions – compare investment plans

- Risk management – estimate profit before buying

- Portfolio planning – see how gold fits with FD, stocks, or mutual funds

📊 Example Calculation

- Gold Price: ₹6,000/gram

- Quantity: 100 grams

- Duration: 10 years

- Expected Growth: 5% annually

➡️ Future Value: ₹9,773,000

➡️ Profit: ₹3,773,000

➡️ ROI: 62.88%

📈 Factors Affecting Gold Prices

- Inflation – gold rises when inflation is high

- Global events – wars, recessions, USD movement

- Central bank policies – interest rates influence demand

- Jewellery demand – festive & wedding seasons in India

- Rupee vs Dollar exchange rate – affects imported gold

💡 Types of Gold Investments

- Physical Gold – coins, bars, jewellery

- Digital Gold – buy online via fintech apps

- Gold ETFs – traded on stock exchanges

- Sovereign Gold Bonds (SGBs) – govt-issued with extra interest

- Gold Mutual Funds – indirect exposure through fund houses

🚫 Common Mistakes in Gold Investment

❌ Buying without checking BIS Hallmark purity

❌ Ignoring making charges in jewellery

❌ Forgetting storage or locker charges

❌ Selling during off-season at lower demand

❌ Putting all savings into gold (no diversification)

❓ Frequently Asked Questions (FAQs)

Q1: Is the gold investment calculator accurate?

The calculator provides estimates based on your inputs (price, duration, growth rate). Actual returns depend on market fluctuations, inflation, and currency changes.

Q2: Can I calculate digital gold returns?

✅ Yes. Enter the current price per gram of digital gold and the calculator works the same way as for physical gold.

Q3: Does it work for tolas or ounces?

Yes but you need convert to grams before entering your values. (1 tola = 11.66 grams, 1 ounce = 28.35 grams).

Q4: What’s a safe growth rate to assume?

Historically, gold in India grows 4–7% per year. For conservative estimates, use 4–5%; for optimistic scenarios, 6–7%.

Q5: Gold vs FD – which is better in 2025?

Gold is a hedge against inflation and performs well in uncertain markets. FDs give guaranteed fixed interest. A balanced portfolio usually includes both gold and FD.

📌 Final Thoughts

A Gold Investment Calculator is a must-use tool before buying gold in 2025. It helps you:

- Predict future value

- Compare with other assets like FD or stocks

- Avoid costly mistakes

💡 Pro Tip: Recalculate your gold ROI every few months to adjust for daily price changes.